A small UK-based manufacturing supplier providing parts to retailers across the country on 30–60 day payment terms often operates with tight cash flow.

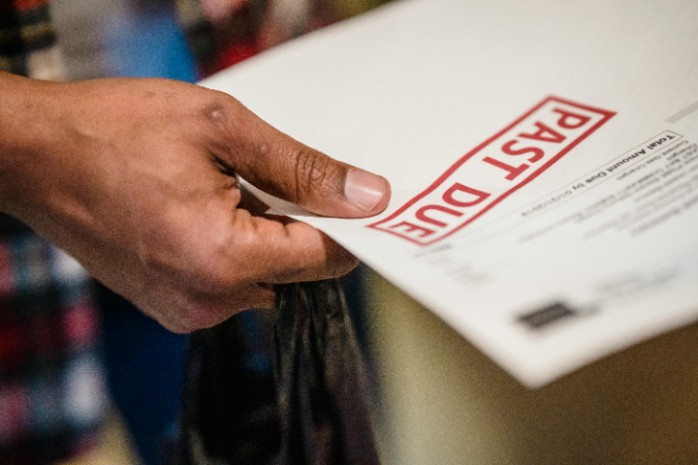

When one long-term customer began paying increasingly late, the business grew concerned. Without clear insight into the client’s financial position, it was difficult to know whether the delays were temporary or indicators of deeper financial distress.

They carried out a full company check, reviewing CCJs, director history, registered addresses, filings, and the overall credit profile.

Enabled real-time monitoring alerts to be notified instantly of new CCJs, director changes, or other risk indicators.

Used the suggested credit limit to determine a safe exposure level for the customer.

Within weeks, an alert revealed that the customer had received a new CCJ and experienced a sharp drop in its recommended credit limit. The supplier paused new deliveries and required part‑payment upfront before proceeding with further orders. This proactive step prevented what could have become a £25,000–£40,000 bad‑debt loss.

Following this incident, the company strengthened its onboarding and credit‑control process. Every new B2B customer is now screened and monitored through AlertFlag before any credit terms are granted.